Have always been We an excellent Candidate for it Type of Financing?

So you want to become familiar with just how can construction funds works? We have been willing to answer one to concern for you. The thing is, structure fund change from mortgage loan loans, however, there are some similarities. This particular article provides you with an overview of the important information on this type of financing. We highlight important what to give ease of insights so you can good state-of-the-art procedure.

How you can determine whether you need to get a property financing is to find knowledgeable. So let’s get right to the providers out of focusing on how construction loans performs. (Read on to learn more.)

What exactly is a home Structure Mortgage

Determining what kind of financial locate will be an excellent part confusing at first. There are various details so you can a property loan, some of which try dependent up on your finances. Still, here are a few of the most extremely well-known ways these loan work:

- Short-name, always maximum of 1 year

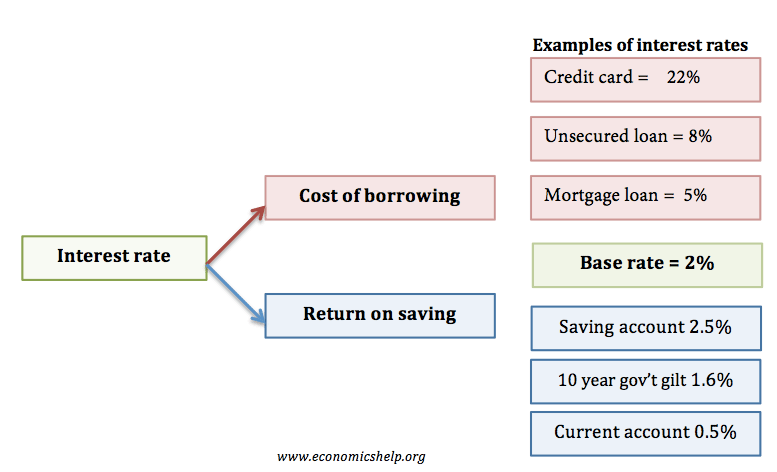

- Higher-Rates of interest

- Varying Prices

- Interest-Merely Commission

- Loan providers track the latest progress of build.

- Money manufactured inside grade as the domestic construction progresses.

- Payments manufactured directly to the creator and you can/or companies and you may subcontractors. (This type of payments are sometimes entitled build brings.)

- Once a certificate out of Occupancy are awarded, a good loans Lakeside Woods CT new financial is required.

There are specific advice you need to pursue to get a home design loan. Subsequent, there is no equity for the new house. (Imagine maybe not-yet-established and therefore absolutely nothing to take hands regarding.) But, about it afterwards. Basic, why don’t we discuss the brand of finance.

A few Types of Structure Money

(1) Framework to Permanent Loans. These mortgage provides money to create brand new house also to home loan it just after developed. He’s unmarried intimate funds and are also less expensive.

(2) Design Just Money. It loan, due to the fact term means, is for the construction phase only. they are entitled stand-alone or two-close financing. Using this types of loan, you will additionally must safer a home loan meaning that a couple separate closings with the fund. It indicates such mortgage shall be costlier. That it mortgage is effectively for you for those who have a beneficial lot of money available.

(3) Repair Funds. This type of come in of numerous models and they are influenced by simply how much financial support you want. To possess remodels around $ten,000, an enthusiastic unsecured unsecured loan is a great alternative. Personal loans do not require equity however you will probably need a good credit score locate one. Another type of financial support option for this type of mortgage is always to just take aside property collateral credit line (HELOC). Having HELOC financing, you borrow secured on brand new readily available collateral of your home.

Exactly how Build Finance

If you’re looking to build yet another house, so it mortgage is for you. An unbelievable benefit to financing of your method of is because they makes your individualized or dream household possible! Financial support alternatives on the type try a gift. It complete the gap from the start regarding construction up until completion, hence means you don’t need to go to until you had all of the dollars to proceed. Let’s be honest, for almost all you, cash capital isnt practical. (Also Dave Ramsey acknowledges that every some one you would like obligations getting a home!)

But really, a construction financing may or may not defense the price of homes therefore the new home. How much money a lender offer for this type of off financing depends on debt picture. (Imagine available cash, income stability, debt-to-income rates and stuff like that.)

Protecting a property financing takes much more work than simply to acquire a house (disappointed, the simple truth is). Basic, you will need to deliver the exact same data files to the bank as you was securing a mortgage getting a property. Along with, you will have to provide the bank to the files outlined less than. Towards brand new home, there is no equity and therefore banking institutions find such loan since a larger chance. To try to get these types of capital, you’ll need:

- Home arrangements and you can demands

Your house might end up costing you more your originally consider. To minimize pressure – in such a circumstance you should always features a funds support accessible to safeguards one budget overruns.

Just what Can cost you Perform This type of Loans Defense?

Funding charges for detachable items like household aren’t anticipate for it brand of financing. Some financial institutions allows the credit regarding equipment.

To start with, you should qualify for the borrowed funds. To do this, again, contemplate home loan degree. Things such as secure earnings, available discounts, and you can cost ability are essential.

Ok, that’s it for the simple and quick post on construction finance. We hope your located this article about how exactly Would Constructions Finance Really works helpful.

Relevant Information from our Blogs

Craig during the Schoenberg Construction is amongst the ideal Domestic Building work Contractors in the St Affect and you may Central Minnesota. The guy usually provides honest, fair offers with no lowball, bogus costs. And there is zero sales stress, Previously! He never spends cheap content and not partcipates in careless craftsmanship. Including, their company is known as among the many ideal design and you will building work companies regarding Saint cloud MN town once the the guy usually insists with the performing most of the business just right.